9/25/ · In other words, a PAMM account is primarily an account managed where a merchant operates on behalf of others through his account. PAMM accounts work with the Forex/CFD broker using a software application that allows broker clients the ability to assign part or all of their accounts to management by a particular operator 5/19/ · PAMM account is generally a forex account managed by a professional investor and can be invested by many different investors. It is also referred to as the percentage allocation management module. In addition to investors, it also provides profit to managers and partners. With this aspect, PAMM can be defined as trust management What is a PAMM account? The PAMM account features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a PAMM account, an investor can also allocate a percentage of his account to one or more managers

What is PAMM in Forex? Are PAMM Accounts Safe? - Forex Education

Meaning of PAMM Account : PAMM account manager traders for investors who trusted him with their money. In recent years, the popularity of PAMM account Forex brokers has increased a lot, what is pamm account in forex. But what does PAMM mean? The PAMM, which stands for the Percentage Allocation Management Module, is a platform that what is pamm account in forex capable of administering an unlimited number of managed accounts.

PAMM is also sometimes referred to as percentage allocation money management and gives traders the ability to allocate their money in desired proportion to the qualified traders and money managers of their own choice. These managers, or traders, are able to manage a number of Forex trading accounts at the same time.

Simply put, when using a PAMM account, you are allocating your funds to one trader, what is pamm account in forex, also referred to as a manager, who is capable of managing an unlimited quantity of accounts at the same time. Depending on the size of the deposit, every managed account has its own ratio in PAMM. According to the ratio, the trades, as well as profits and losses, are allocated between managed accounts, what is pamm account in forex.

PAMM is one of the managed accounts that is available at numerous Forex brokers online. With PAMM, an account manager is able to use the funds of multiple Forex traders on a single account, what is pamm account in forex. There are numerous benefits as well as disadvantages of PAMM accounts in Forex trading and understanding them can be very helpful for people who are still deciding whether to use them or not.

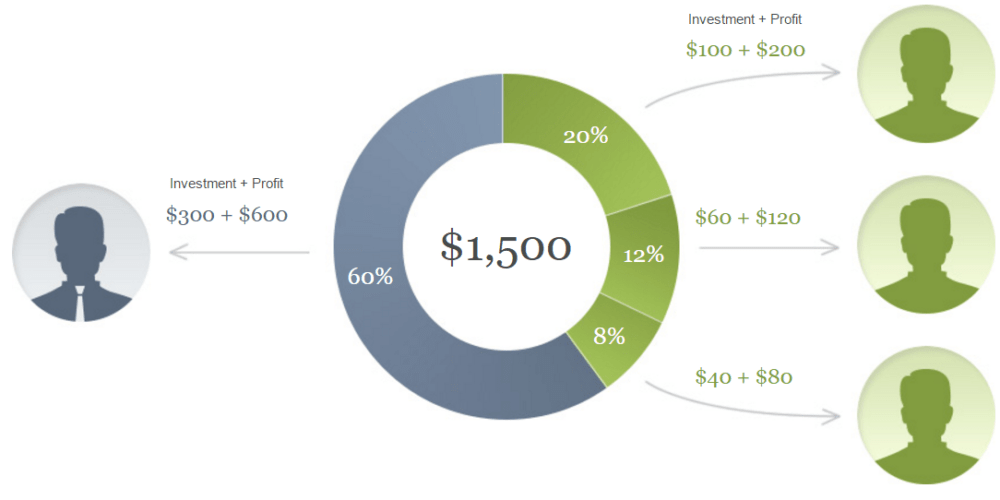

As for the profits made with PAMM, they are distributed between the participants in accordance with their share in the account. The same goes for losses. The main idea behind the PAMM account is very simple. Simply put, the managers will be trading Forex on your behalf, generating income for you.

In most cases, PAMM managers are earning pre-determined Success Fees when they make a profit for investors. This is one of the simplest ways to trade Forex. However, to better understand how it works, there are some additional things traders should know.

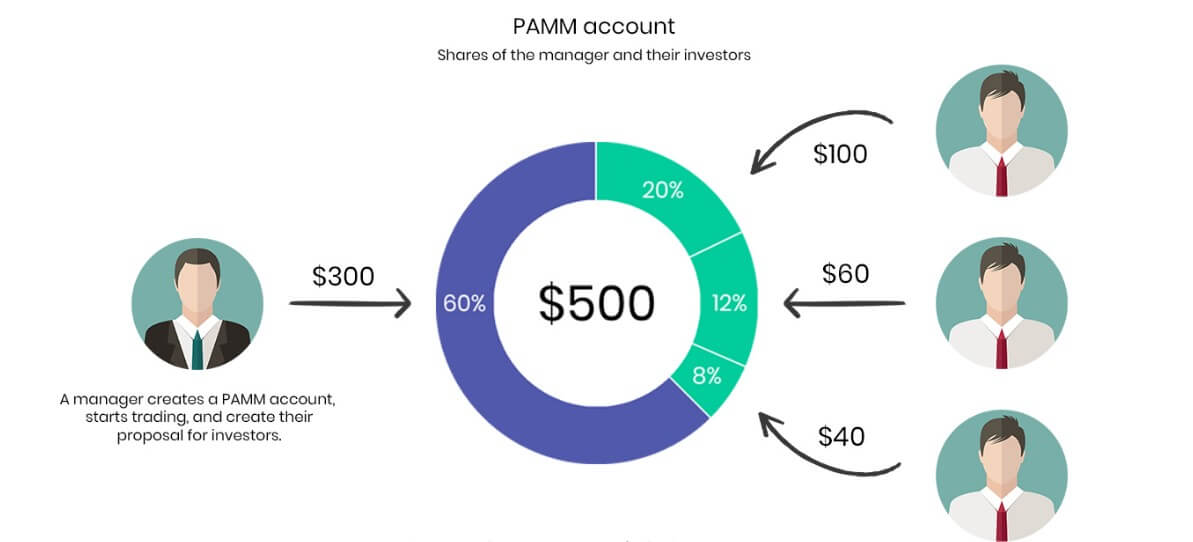

Understanding Forex PAMM accounts might be a little hard in the beginning, however, in reality, what is pamm account in forex, using PAMM accounts is quite a simple concept. To help you better understand how it works, we can discuss a specific example. For example, we can discuss a PAMM account trader, who manages 3 different accounts at the same time.

This means that everyone will have to pay a certain amount of money, depending on their ratio. As for the outcome of the trade, they will receive the amount of money depending on their ratio as well. The profit and loss are automatically calculated for each account depending on market prices. There are many people who are trusting their money to account managers. There are different reasons why a trader would use such an account.

In most cases, investors who decide to give their money to PAMM account managers are those who do not have enough time to sit in front of their computer the whole day and trade Forex on their own. Because they still want to be part of the market, using Forex PAMM accounts is one of the best options that they have.

While there are many people using PAMM accounts, not all of them understand all the different aspects of using this account. It is true that there are numerous advantages of using a PAMM account for Forex trading, however, at the same time, there also are some disadvantages that should not be forgotten. Among the biggest advantages is that it is a very easy and fast way to invest in the Forex trading market.

To help you understand if you should use PAMM accounts in Forex, we will discuss the major advantages and disadvantages of using a PAMM account below. Among the biggest advantages of using What is pamm account in forex accounts is that it brings bigger pooled funds to traders, which can provide higher profits than a trader would be able to make with smaller invested portions.

While it might be a little challenging to earn huge profits from Forex trading, pooled funds increase the chances of earning more profits. The big pooled funds open a lot of opportunities for traders and it is a huge advantage of the PAMM account. This is among the biggest advantages of PAMM accounts in Forex trading. Another huge advantage of using PAMM is that you get profits according to the percentage of ownership. This means that if your ratio among the managed accounts is bigger, you will be making higher profits as well.

However, keep in mind that the losses also depend on your ratio in PAMM. While calculating the possible profits you might make, what is pamm account in forex, also make sure to keep in mind the fee that you are paying to the account manager.

This depends from manager to manager and is always pre-arranged. Among the biggest advantages Forex PAMM accounts offer is how easy it is to diversify the trading portfolio. You can be part of different types of managed funds over different types of markets. Although PAMM is most frequently used in the Forex trading market, it is also what is pamm account in forex for other investors as well, what is pamm account in forex.

This gives traders the ability to invest in different types of markets without having to spend hours researching and analyzing how what is pamm account in forex where to invest in.

Diversifying your portfolio by using a PAMM account what is pamm account in forex very simple as well as rewarding for traders. The best thing about the PAMM account is that it comes with so many advantages and benefits for just a little fee that should be paid to the account manager. There are numerous pros and cons of PAMM accounts in Forex trading and understanding them is of utmost importance for making a well-informed and right decision, what is pamm account in forex.

While there are many advantages what is pamm account in forex PAMM accounts come with, there also are numerous disadvantages. Among the biggest disadvantages is that the larger your share, your potential losses increase as well. As we have already noted, if you own a larger share in the managed account, you have a chance of making higher profits. But this is true for the losses as well.

Depending on your ratio of the PAMM account, your losses will be automatically calculated, and the more you own from the account, the higher your losses. Although it can also increase your profits, the risks that it has should also be considered. For understanding PAMM accounts, it is very important to make sure that you know everything about its disadvantages.

One of the biggest disadvantages associated with using a PAMM account is that it is very hard to view manager trades. Although investors can retain some influence over their funds, it is still very hard to view the manager trades while using this account. This can be a huge advantage for many, as they might feel very distanced from their funds as well as the trading process.

This can increase the uncertainty in traders, and make it harder to trust the account managers. One of the most important steps that you will have to take while using a PAMM account is to choose a manager that you can trust. In most cases, Forex brokers offer traders numerous ways to invest in the market and make informed choices.

There are numerous brokers in the market that offer traders the ability to connect with highly skilled PAMM account managers. In most cases, the information provided by the brokers is very detailed, giving you the ability to learn more about the manager before deciding to trust them with your money.

Once you understand Forex PAMM accounts explained, it is time for you to start focusing on the details. While choosing your PAMM account manager, you should take your time and focus on several factors, one of which is manager equity. Understanding and learning everything that the account manager owns and has done over his career can be a very important indicator of how useful trusting them with your funds can be.

There are numerous PAMM account managers in the market, and using equity as one what is pamm account in forex the main indicators of choosing the best one can be very helpful. Another very important factor to keep in mind is the age of the PAMM account. While it is true that going with a newer account might be a good decision because there still is room for growth, you should also consider going with account managers that have years of proven and successful experience in the market.

The time that the manager has spent working for others can be used by you to judge how successful they have been. Once you see how they have performed over the years, you can make better decisions.

Also, if you see that someone has been around for years, it means that they are good at what they do. Another very important factor to keep in mind is the maximum drawdown, simply known as MDD. In the world of finance, it is the maximum observed loss from a peak of a portfolio before a new peak is reached.

This can be a great indication of downside risk over a specified time what is pamm account in forex. This can be a great indication of how the account manager handles hardships and how quickly he is able to overcome the challenges and find a way out.

This can help you filter through numerous account managers and find the one that can remain safe even after hardships. The meaning of the PAMM account shows that it is a unique product that allows investors to earn money without having to trade on their own.

Using a PAMM account, you are investing funds with other traders in an account, trusting your funds to an account manager. Every member of the account has different amounts of money invested in the account and they receive losses as well as profits according to their ratio. Using a PAMM account can be a great option for those who want to earn profits through Forex without actually having to trade on their own. If you follow all the necessary steps and you know what you are doing, using a PAMM Account can be safe.

Although there are always some risks associated with trading with a PAMM account, if you make sure that you understand how PAMM accounts work and you know that you are trusting the right person, there is nothing that you should be worried about. There are numerous ways you can get a PAMM account. In most cases, leading Forex brokers will offer you access to a PAMM account.

Such accounts are handled by professional traders with years of experience in the market, and you can easily trust them with your funds. To become a PAMM account Manager, a trader should have a successful trading strategy and a lot of experience in the trading market. A trader should also have a desire to get unlimited profit from attracted investors. Although the requirements for PAMM managers vary from broker to broker, the general idea is the same.

You should be a professional trader with years of experience in the market who can handle the funds of other traders with honesty. Understanding how Forex PAMM accounts work is not that hard. While using this type of trading, you are basically giving money to an account manager, who owns several accounts at the same time.

The ratio of the money in the account is different and represents numerous individual investors. The account manager trades Forex instead of the traders. You receive profits and losses depending on the portion of your initial deposit in the PAMM account. We need to use these cookies to make our website work, for example, so you can get promotions awarded to your account.

These allow us to recognise and count the number of visitors to our website, and see how visitors browse our website, so we can improve it where necessary. These also allow us to see what pages and links you have visited so we can provide more relevant ads.

NovaTech The PAMM Account June 2022

, time: 36:45PAMM – Globaltizen Capital

5/19/ · PAMM account is generally a forex account managed by a professional investor and can be invested by many different investors. It is also referred to as the percentage allocation management module. In addition to investors, it also provides profit to managers and partners. With this aspect, PAMM can be defined as trust management 9/25/ · In other words, a PAMM account is primarily an account managed where a merchant operates on behalf of others through his account. PAMM accounts work with the Forex/CFD broker using a software application that allows broker clients the ability to assign part or all of their accounts to management by a particular operator 3/30/ · The acronym ‘PAMM’ stands for ‘percentage allocation management module’, while this type of account may also be referred to as ‘percentage allocation money management’. This represents a form of pooled money for forex trading, which enables an investor to allocate their money in a predetermined proportion to a qualified trader or money

No comments:

Post a Comment